Chapter 01: Finite Sample Properties of OLS

Lachlan Deer

2019-03-04

Source:vignettes/chapter-01.Rmd

chapter-01.RmdApplication: Returns to Scale in Electricity Supply

Load the hayashir package

library(hayashir)The Data

Let’s get a quick look at our data by looking at the first 10 rows:

head(nerlove, 10)

#> total_cost output price_labor price_fuel price_capital

#> 1 0.082 2 2.09 17.9 183

#> 2 0.661 3 2.05 35.1 174

#> 3 0.990 4 2.05 35.1 171

#> 4 0.315 4 1.83 32.2 166

#> 5 0.197 5 2.12 28.6 233

#> 6 0.098 9 2.12 28.6 195

#> 7 0.949 11 1.98 35.5 206

#> 8 0.675 13 2.05 35.1 150

#> 9 0.525 13 2.19 29.1 155

#> 10 0.501 22 1.72 15.0 188Some information about the variables in the data can be found in the documentation:

And we can gain an understanding of the structure of our data by:

str(nerlove)

#> Classes 'tbl_df', 'tbl' and 'data.frame': 145 obs. of 5 variables:

#> $ total_cost : num 0.082 0.661 0.99 0.315 0.197 0.098 0.949 0.675 0.525 0.501 ...

#> $ output : num 2 3 4 4 5 9 11 13 13 22 ...

#> $ price_labor : num 2.09 2.05 2.05 1.83 2.12 2.12 1.98 2.05 2.19 1.72 ...

#> $ price_fuel : num 17.9 35.1 35.1 32.2 28.6 28.6 35.5 35.1 29.1 15 ...

#> $ price_capital: num 183 174 171 166 233 195 206 150 155 188 ...And by using the skim command from the skimr package we can look at summary statistics:

# install.packages("skimr")

library(skimr)

skim(nerlove)

#> Skim summary statistics

#> n obs: 145

#> n variables: 5

#>

#> Variable type: numeric

#> variable missing complete n mean sd p0 p25 median

#> output 0 145 145 2133.08 2931.94 2 279 1109

#> price_capital 0 145 145 174.5 18.21 138 162 170

#> price_fuel 0 145 145 26.18 7.88 10.3 21.3 26.9

#> price_labor 0 145 145 1.97 0.24 1.45 1.76 2.04

#> total_cost 0 145 145 12.98 19.79 0.082 2.38 6.75

#> p75 p100 hist

#> 2507 16719 ▇▂▁▁▁▁▁▁

#> 183 233 ▁▆▇▆▃▂▁▁

#> 32.2 42.8 ▃▂▃▇▇▃▅▂

#> 2.19 2.32 ▂▁▇▃▃▇▇▆

#> 14.13 139.42 ▇▁▁▁▁▁▁▁Testing Homogeneity of the cost function

The Unrestricted Model

unrestricted_ls <- log(total_cost) ~ log(output) +

log(price_labor) + log(price_capital) + log(price_fuel)

model1 <- lm(unrestricted_ls, data = nerlove)

summary(model1)

#>

#> Call:

#> lm(formula = unrestricted_ls, data = nerlove)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -0.97784 -0.23817 -0.01372 0.16031 1.81751

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -3.52650 1.77437 -1.987 0.0488 *

#> log(output) 0.72039 0.01747 41.244 < 2e-16 ***

#> log(price_labor) 0.43634 0.29105 1.499 0.1361

#> log(price_capital) -0.21989 0.33943 -0.648 0.5182

#> log(price_fuel) 0.42652 0.10037 4.249 3.89e-05 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 0.3924 on 140 degrees of freedom

#> Multiple R-squared: 0.926, Adjusted R-squared: 0.9238

#> F-statistic: 437.7 on 4 and 140 DF, p-value: < 2.2e-16Scale Coefficient:

return_to_scale <- 1 / model1$coefficients[2]

print(return_to_scale)

#> log(output)

#> 1.388129t-stat: The car package provides the linearHypothesis package which provides an easy way to test linear hypotheses:

library(car)

#> Loading required package: carData

linearHypothesis(model1, c("log(price_capital) = 0"))

#> Linear hypothesis test

#>

#> Hypothesis:

#> log(price_capital) = 0

#>

#> Model 1: restricted model

#> Model 2: log(total_cost) ~ log(output) + log(price_labor) + log(price_capital) +

#> log(price_fuel)

#>

#> Res.Df RSS Df Sum of Sq F Pr(>F)

#> 1 141 21.617

#> 2 140 21.552 1 0.064605 0.4197 0.5182

# relationship between t and F = F = t^2

test_results <- linearHypothesis(model1, c("log(price_capital) = 0"))

# ie. same as above

t_stat <- sqrt(test_results$F)The Restricted Model

Following the book:

restricted_ls <- log(total_cost/price_fuel) ~ log(output) +

log(price_labor/price_fuel) + log(price_capital / price_fuel)

model2 <- lm(restricted_ls, data = nerlove)

summary(model2)

#>

#> Call:

#> lm(formula = restricted_ls, data = nerlove)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -1.01200 -0.21759 -0.00752 0.16048 1.81922

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -4.690789 0.884871 -5.301 4.34e-07 ***

#> log(output) 0.720688 0.017436 41.334 < 2e-16 ***

#> log(price_labor/price_fuel) 0.592910 0.204572 2.898 0.00435 **

#> log(price_capital/price_fuel) -0.007381 0.190736 -0.039 0.96919

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 0.3918 on 141 degrees of freedom

#> Multiple R-squared: 0.9316, Adjusted R-squared: 0.9301

#> F-statistic: 640 on 3 and 141 DF, p-value: < 2.2e-16Next, Hayashi provides a routine to compute the F-stat to test the restriction. First, we proceed as he instructs:

We can find SSR from the anova function:

anova(model1)

#> Analysis of Variance Table

#>

#> Response: log(total_cost)

#> Df Sum Sq Mean Sq F value Pr(>F)

#> log(output) 1 264.995 264.995 1721.3849 < 2.2e-16 ***

#> log(price_labor) 1 1.735 1.735 11.2688 0.001015 **

#> log(price_capital) 1 0.005 0.005 0.0333 0.855374

#> log(price_fuel) 1 2.780 2.780 18.0581 3.889e-05 ***

#> Residuals 140 21.552 0.154

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1We need to get SSR_u from model 1 and the denominator df. The anova() function returns a data.frame from which we need to extract:

- the SSR - located in the last row of the

Sum_Sqcolumn - The degress of freedom - located in the last row of the

Dfcolumn

To get them:

anova_model1 <- anova(model1)

final_row_u <- nrow(nrow(anova_model1))

SSR_u <- anova_model1$`Sum Sq`[final_row_u]

df_resid_u <- anova_model1$Df[final_row_u]and doing the same for the for the restricted model:

anova_model2 <- anova(model2)

final_row_r <- nrow(nrow(anova_model2))

SSR_r <- anova_model2$`Sum Sq`[final_row_r]

df_resid_r <- anova_model2$Df[final_row_r]Then our F-stat can be computed as:

f_stat <- ( (SSR_r - SSR_u) / (df_resid_r - df_resid_u)) / (SSR_u / (df_resid_u))

print(paste("F stat is:", f_stat))

#> [1] "F stat is: "Which has a p-value of

pf(f_stat, df_resid_r - df_resid_u, df_resid_u, lower.tail = FALSE)

#> numeric(0)Alternatively, we can look at the F-stat versus a critical value.# The critical value at 5% is

qf(0.05, df_resid_r - df_resid_u, df_resid_u, lower.tail = FALSE)

#> numeric(0)Testing Restrictions in an Easier way

Though instructive, that was kind of complicated … a simpler version would be using the linearHypothesis function that we have already seen. We specifying the restriction we want to impose:

linearHypothesis(model1, "log(price_labor) + log(price_capital) + log(price_fuel) = 1")

#> Linear hypothesis test

#>

#> Hypothesis:

#> log(price_labor) + log(price_capital) + log(price_fuel) = 1

#>

#> Model 1: restricted model

#> Model 2: log(total_cost) ~ log(output) + log(price_labor) + log(price_capital) +

#> log(price_fuel)

#>

#> Res.Df RSS Df Sum of Sq F Pr(>F)

#> 1 141 21.640

#> 2 140 21.552 1 0.088311 0.5737 0.4501Detour: a cautionary note on \(R^2\)

scale_effect <- log(total_cost / output) ~ log(output ) +

log(price_labor ) + log(price_capital ) + log(price_fuel)

model3 <- lm(scale_effect, data = nerlove)

summary(model3)

#>

#> Call:

#> lm(formula = scale_effect, data = nerlove)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -0.97784 -0.23817 -0.01372 0.16031 1.81751

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -3.52650 1.77437 -1.987 0.0488 *

#> log(output) -0.27961 0.01747 -16.008 < 2e-16 ***

#> log(price_labor) 0.43634 0.29105 1.499 0.1361

#> log(price_capital) -0.21989 0.33943 -0.648 0.5182

#> log(price_fuel) 0.42652 0.10037 4.249 3.89e-05 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 0.3924 on 140 degrees of freedom

#> Multiple R-squared: 0.6948, Adjusted R-squared: 0.6861

#> F-statistic: 79.69 on 4 and 140 DF, p-value: < 2.2e-16Testing Constant Returns to Scale

linearHypothesis(model2, "log(output) = 1")

#> Linear hypothesis test

#>

#> Hypothesis:

#> log(output) = 1

#>

#> Model 1: restricted model

#> Model 2: log(total_cost/price_fuel) ~ log(output) + log(price_labor/price_fuel) +

#> log(price_capital/price_fuel)

#>

#> Res.Df RSS Df Sum of Sq F Pr(>F)

#> 1 142 61.027

#> 2 141 21.640 1 39.386 256.63 < 2.2e-16 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Which again returns an F-stat. We can map that into a t-stat as follows:

f_stat2 <- linearHypothesis(model2, "log(output) = 1")

t_stat2 <- sqrt(f_stat2$F[2])

print(paste("t stat is:", t_stat2))

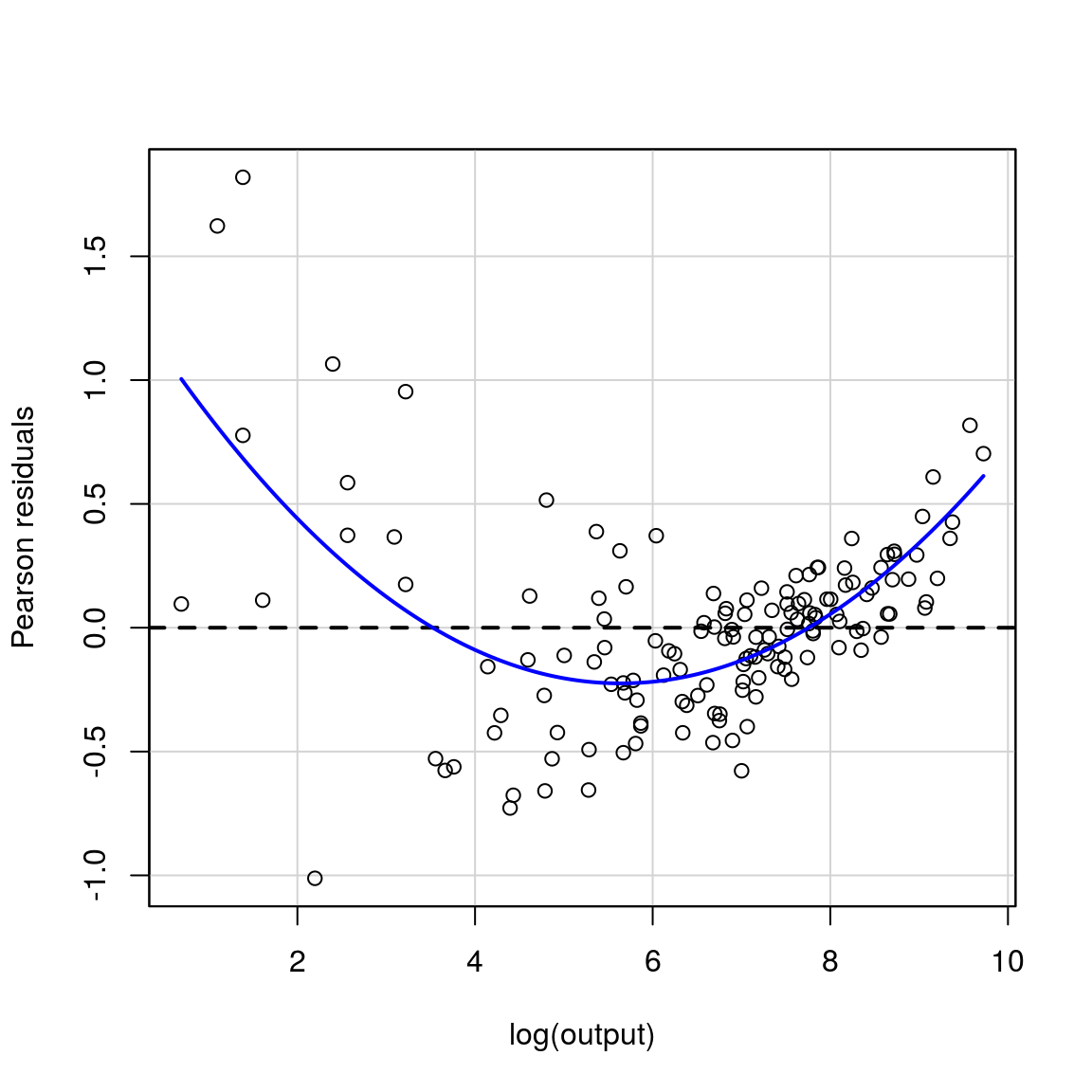

#> [1] "t stat is: 16.0195576357841"Importance of plotting residuals

The car package again helps us. car comes with a function residualPlot which will plot residuals against fitted values (by default), or against a specified variable, in our case log(output)

# residual plot comes from car package

residualPlot(model2, variable = "log(output)")