Chapter 06: Serial Correlation

Lachlan Deer

2019-03-04

Source:vignettes/chapter-06.Rmd

chapter-06.RmdApplication: Forward Exchange Rates as Optimal Predictors

Load the hayashir package

library(hayashir)And other libraries we need for this chapter

library(dplyr) # data manipulation

#>

#> Attaching package: 'dplyr'

#> The following objects are masked from 'package:stats':

#>

#> filter, lag

#> The following objects are masked from 'package:base':

#>

#> intersect, setdiff, setequal, union

library(ggplot2) # plotting

library(forecast) # time series plotting - Acf

library(sandwich) # HAC standard errors

library(lmtest)

#> Loading required package: zoo

#>

#> Attaching package: 'zoo'

#> The following objects are masked from 'package:base':

#>

#> as.Date, as.Date.numeric

#>

#> Attaching package: 'lmtest'

#> The following object is masked from 'package:hayashir':

#>

#> moneydemand

library(car)

#> Loading required package: carData

#>

#> Attaching package: 'car'

#> The following object is masked from 'package:dplyr':

#>

#> recodeThe Data

Let’s get a quick look at our data by looking at the first 10 rows:

head(yen, 10)

#> # A tibble: 10 x 4

#> date spot_rate forward_30 spot_30

#> <date> <dbl> <dbl> <dbl>

#> 1 1975-01-03 301. 301. 297.

#> 2 1975-01-10 301. 301. 295.

#> 3 1975-01-17 301. 300. 293.

#> 4 1975-01-24 296. 296. 286.

#> 5 1975-01-31 298. 298. 287.

#> 6 1975-02-07 296. 296. 286.

#> 7 1975-02-14 293. 293. 288.

#> 8 1975-02-21 291. 292. 288.

#> 9 1975-02-28 286. 286. 291.

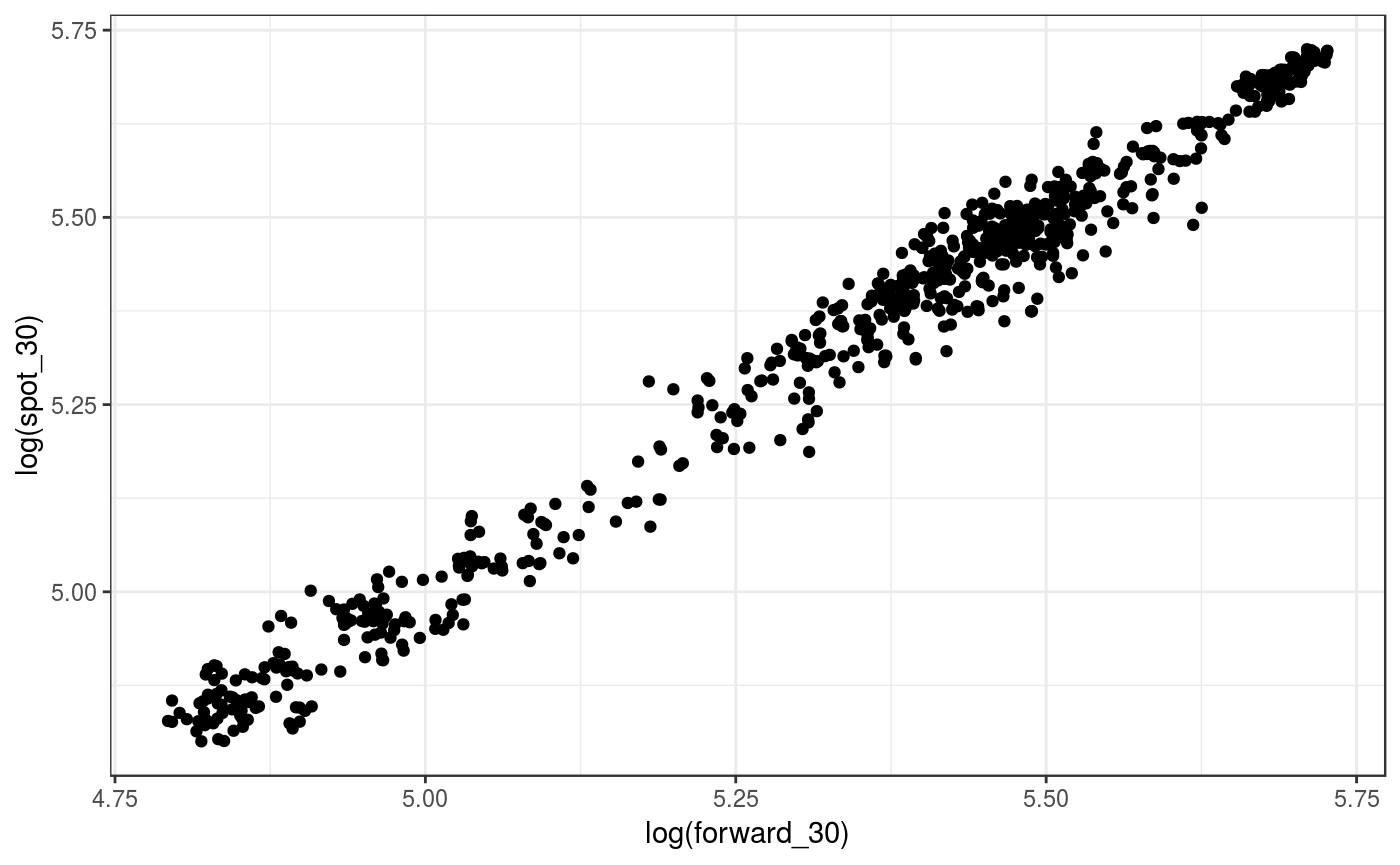

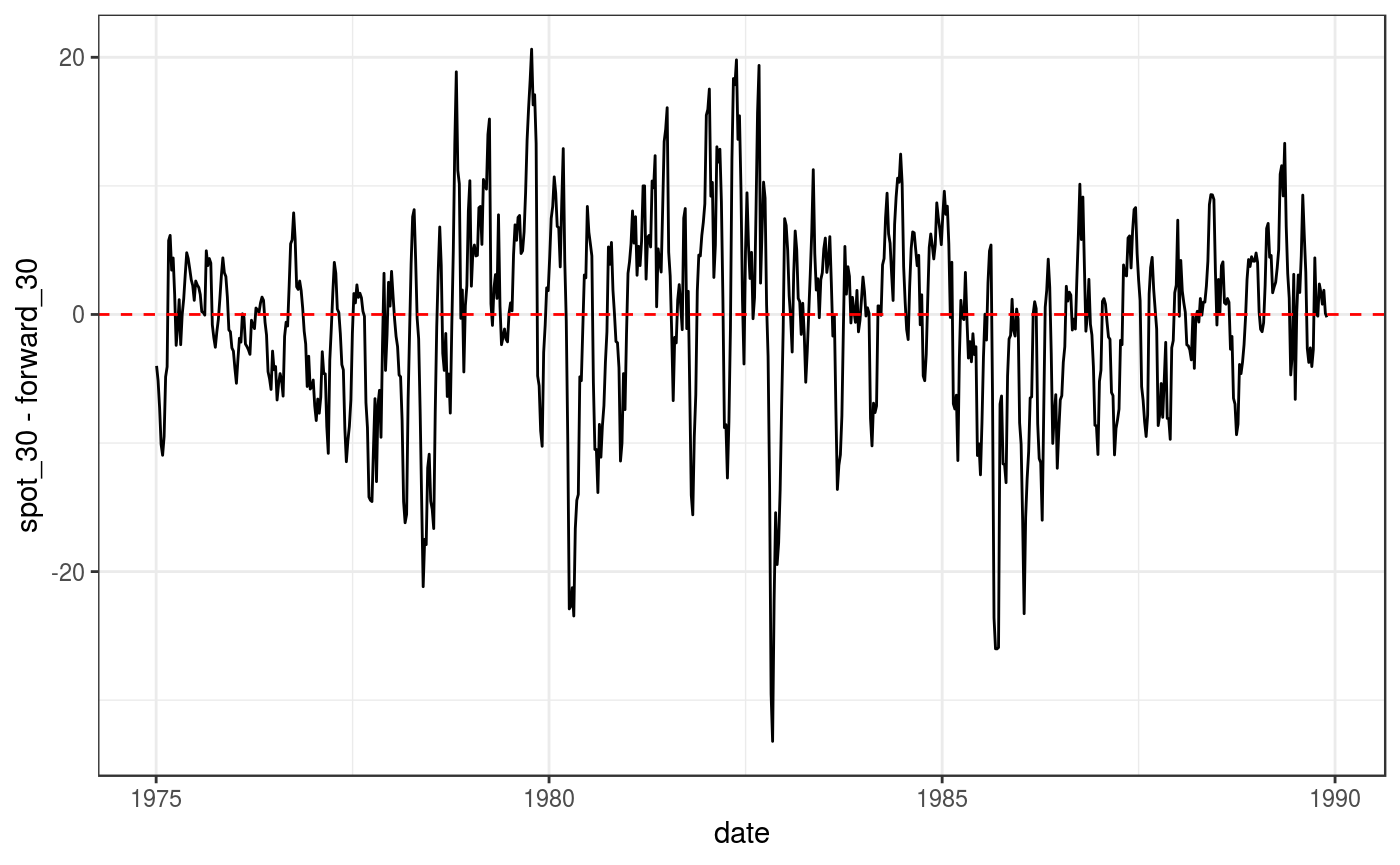

#> 10 1975-03-07 286. 285. 292.Figure 6.1: Forecast Error: Yen/Dollar

ggplot(data = yen, aes(x = date, y = spot_30 - forward_30))+

geom_line() +

geom_hline(yintercept = 0, linetype="dashed", color = "red") +

theme_bw()

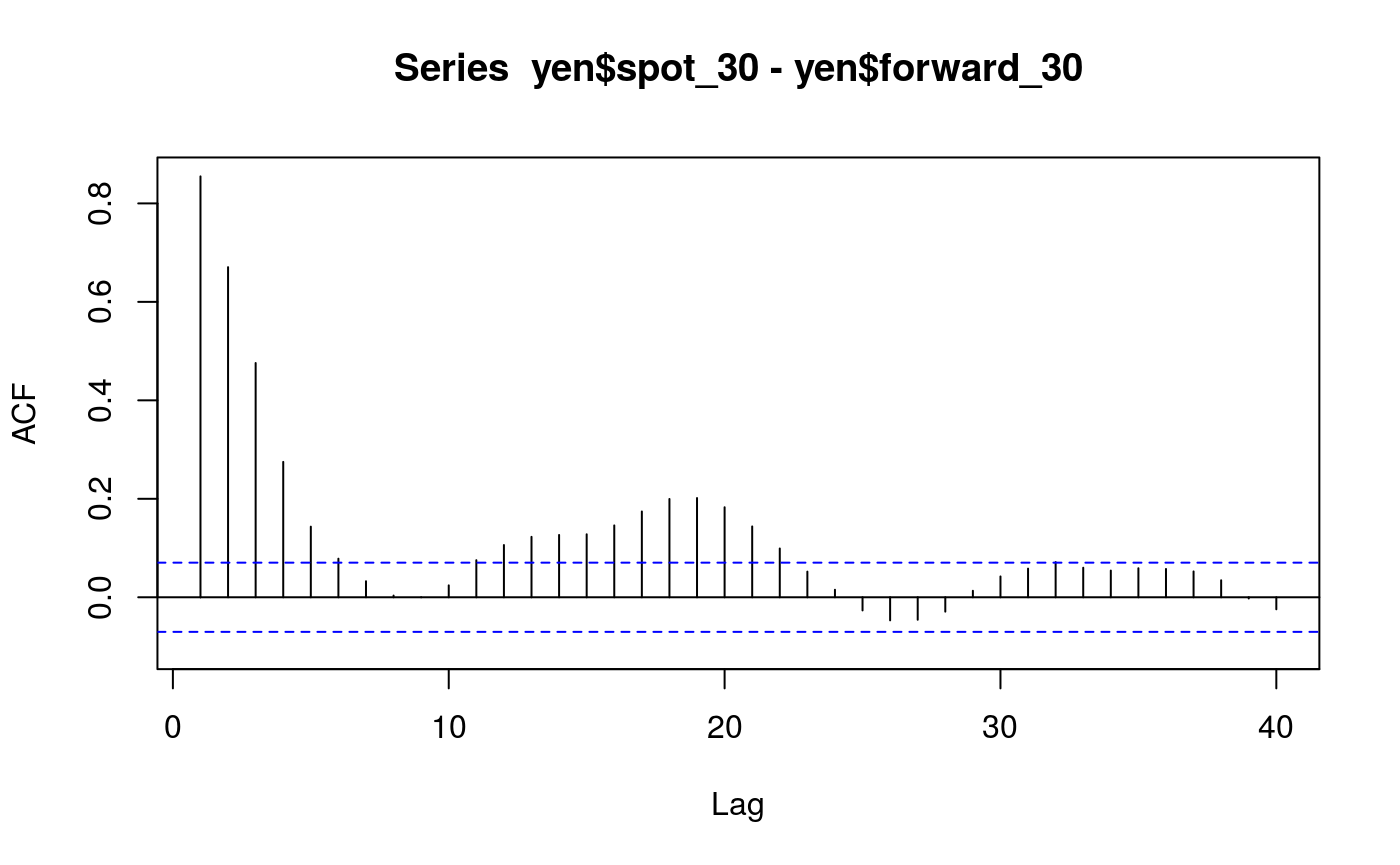

Figure 6.2: Correlogram of \(s30 - f\), Yen/Dollar

The Acf function from the forecast package will do what we need here:

Acf(yen$spot_30 - yen$forward_30, lag.max = 40)

Figure 6.3: Yen/Dollar Spot Rate, Jan 1975 - Dec 1989

ggplot(data = yen, aes(x = date, y = spot_rate))+

geom_line() +

scale_x_date(date_breaks = "3 years", date_labels = "%m/%y") +

theme_bw()

Table 6.2: Regression Tests for Market Efficiency

For the Yen/Dollar:

mkt_eff <- lm (I(spot_30 - spot_rate) ~ I(forward_30 - spot_rate), data = yen)

summary(mkt_eff)

#>

#> Call:

#> lm(formula = I(spot_30 - spot_rate) ~ I(forward_30 - spot_rate),

#> data = yen)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -33.105 -3.554 1.084 4.508 18.876

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -1.9700 0.3507 -5.618 2.70e-08 ***

#> I(forward_30 - spot_rate) -1.6783 0.3720 -4.512 7.42e-06 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 7.21 on 776 degrees of freedom

#> Multiple R-squared: 0.02556, Adjusted R-squared: 0.02431

#> F-statistic: 20.36 on 1 and 776 DF, p-value: 7.424e-06These results give standard errors under the assumption of heteroskedasticity. To correct for heteroskedasticity and autocorrelation we want HAC standard errors from the sandwich package. In particular standard errors with a maximum of 4 lags that are not pre-whitened. To get a summary of the regression we use the coeftest function from the lm package

coeftest(mkt_eff, vcov = vcovHAC(mkt_eff, lag = 4, prewhite = FALSE))

#>

#> t test of coefficients:

#>

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -1.96996 0.70083 -2.8109 0.005065 **

#> I(forward_30 - spot_rate) -1.67835 0.68199 -2.4610 0.014073 *

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1To test that \(\beta_0 =0\) and \(\beta_1 = 1\) we use the linearHypothesis function from car

linearHypothesis(mkt_eff, c("(Intercept) = 0", "I(forward_30 - spot_rate) = 1"),

vcov = vcovHAC(mkt_eff, lag = 4, prewhite = FALSE))

#> Linear hypothesis test

#>

#> Hypothesis:

#> (Intercept) = 0

#> I(forward_30 - spot_rate) = 1

#>

#> Model 1: restricted model

#> Model 2: I(spot_30 - spot_rate) ~ I(forward_30 - spot_rate)

#>

#> Note: Coefficient covariance matrix supplied.

#>

#> Res.Df Df F Pr(>F)

#> 1 778

#> 2 776 2 8.1846 0.0003037 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Figure 6.5: Plot of \(s30-s\) against \(f - s\), Yen/Dollar

ggplot(data = yen, aes(x = forward_30 - spot_rate, y = spot_30 - spot_rate))+

geom_point() +

geom_smooth(method = "lm", se = FALSE, color = "red") +

theme_bw()