Chapter 02: Large Sample Theory

Lachlan Deer

2019-03-04

Source:vignettes/chapter-02.Rmd

chapter-02.RmdLoad Libraries

library(hayashir)

library(ggplot2)

library(dplyr)

#>

#> Attaching package: 'dplyr'

#> The following objects are masked from 'package:stats':

#>

#> filter, lag

#> The following objects are masked from 'package:base':

#>

#> intersect, setdiff, setequal, union

library(zoo)

#>

#> Attaching package: 'zoo'

#> The following objects are masked from 'package:base':

#>

#> as.Date, as.Date.numericInspecting the Data

head(mishkin)

#> # A tibble: 6 x 7

#> year month inflation_1 inflation_3 tbill_1 tbill_3 cpi

#> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

#> 1 1950 2 -3.55 1.13 1.10 1.13 23.5

#> 2 1950 3 5.25 4.00 1.13 1.14 23.6

#> 3 1950 4 1.69 4.49 1.12 1.14 23.6

#> 4 1950 5 5.06 7.82 1.15 1.18 23.7

#> 5 1950 6 6.72 9.43 1.16 1.17 23.8

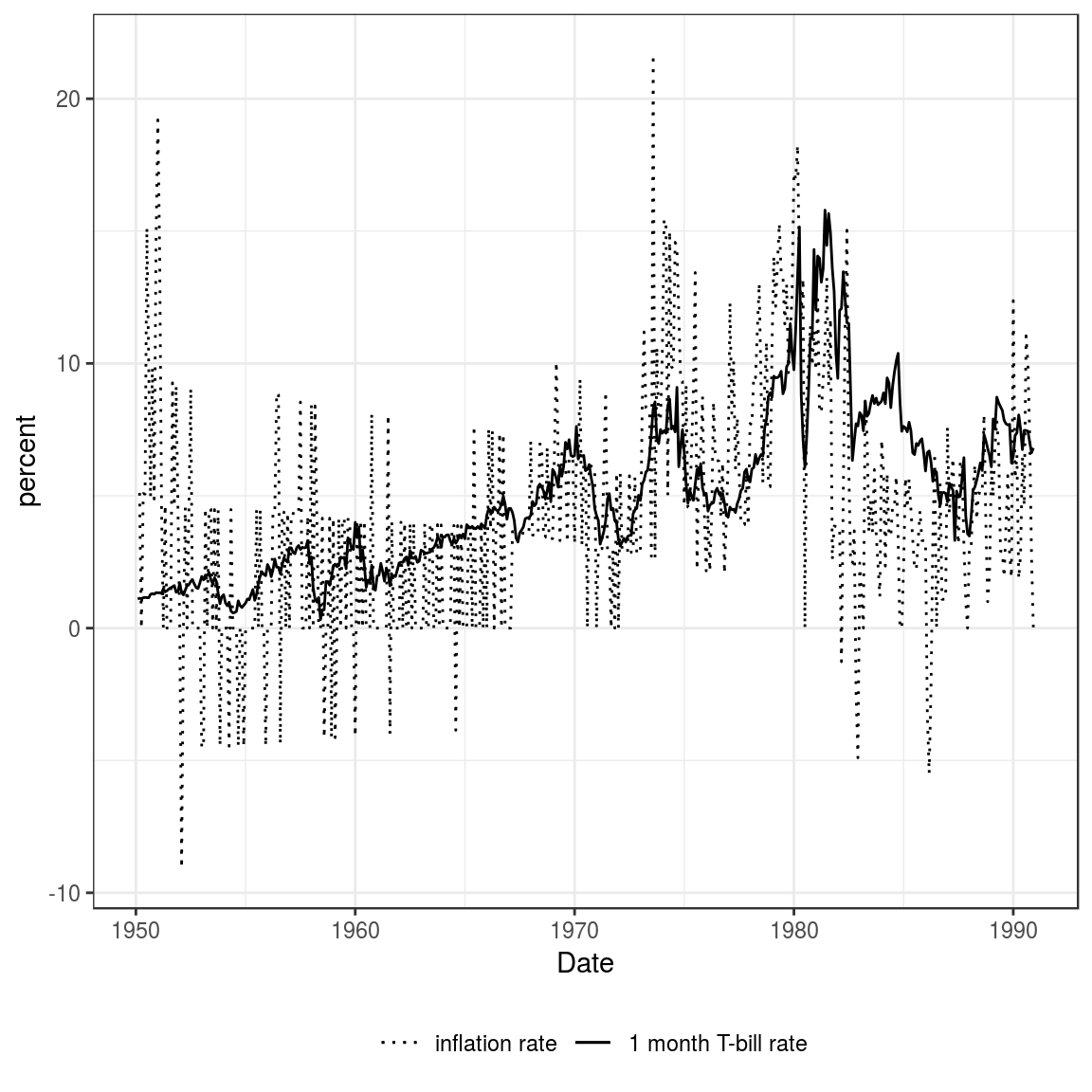

#> 6 1950 7 11.7 9.98 1.15 1.17 24.1Figure 2.3

First we construct a date variable and then calculate CPI inflation The library zoo contains the function as.yearmon() to construct dates containing only year and months.

mishkin2 <- mishkin %>%

mutate(time_period = as.yearmon(paste(year, month, sep = "-")),

cpi_inflation = (cpi/lag(cpi) - 1) * 100 * 12

)

Now we plot the data:

ggplot(mishkin2) +

geom_line(aes(time_period, tbill_1, linetype = "tbill_1")) +

geom_line(aes(time_period, cpi_inflation, linetype = "cpi_inflation")) +

xlab("Date") +

ylab("percent") +

theme_bw() +

theme(legend.position="bottom") +

scale_linetype_manual(name = element_blank(),

values = c(tbill_1 = "solid", cpi_inflation = "dotted"),

labels = c("inflation rate", "1 month T-bill rate")

)

#> Don't know how to automatically pick scale for object of type yearmon. Defaulting to continuous.

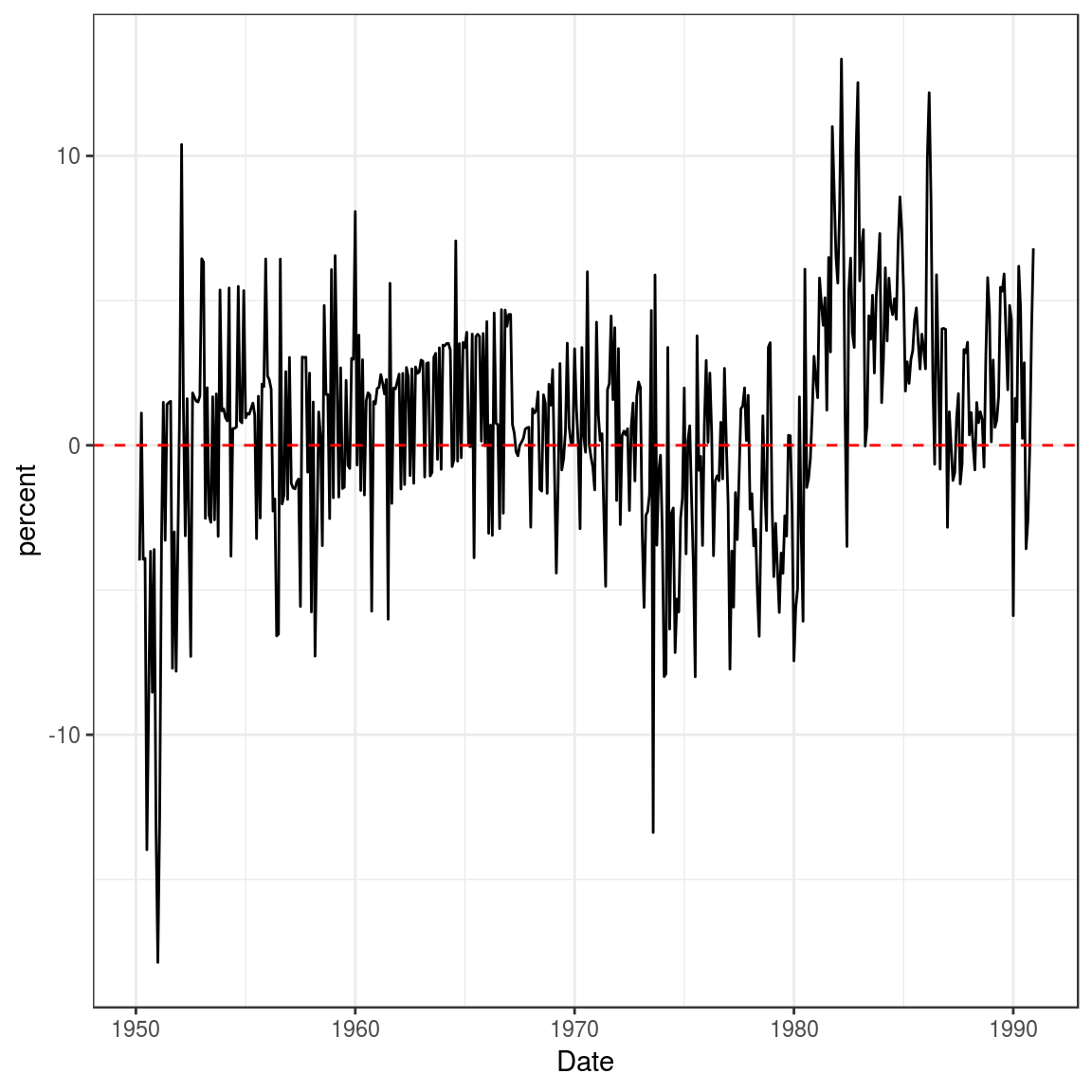

Figure 2.4

Compute real interest rate:

mishkin2 <- mishkin2 %>%

mutate(real_rate = tbill_1 - cpi_inflation)And now plot:

ggplot(mishkin2) +

geom_line(aes(time_period, real_rate, linetype = "tbill_1")) +

geom_hline(yintercept = 0, linetype = "dashed", color = "red") +

xlab("Date") +

ylab("percent") +

theme_bw() +

theme(legend.position="none")

#> Don't know how to automatically pick scale for object of type yearmon. Defaulting to continuous.

#> Warning: Removed 1 rows containing missing values (geom_path).

Table 2.1

First we subset the data. The relevant Date range is January 1953 to July 1971.

fama <- mishkin2 %>%

filter(between(as.yearmon(time_period),

as.yearmon("Jan 1953"),

as.yearmon("Jul 1971")

)

)

#> Warning: between() called on numeric vector with S3 classlibrary(skimr)

skim(fama$real_rate)

#> Skim summary statistics

#>

#> Variable type: numeric

#> variable missing complete n mean sd p0 p25 median p75

#> fama$real_rate 0 223 223 0.89 2.77 -7.28 -0.99 1.1 2.77

#> p100 hist

#> 8.08 ▁▁▃▆▇▆▂▁Then the ACF

acf(fama$real_rate, lag.max = 12, plot = FALSE)

#>

#> Autocorrelations of series 'fama$real_rate', by lag

#>

#> 0 1 2 3 4 5 6 7 8 9

#> 1.000 -0.105 0.173 -0.018 -0.007 -0.063 -0.025 -0.094 0.088 0.090

#> 10 11 12

#> 0.017 0.004 0.206Then the Ljung Box Q tests (use the portes package for more flexibility)

library(portes)

#> Loading required package: parallelLjungBox(fama$real_rate, lags = seq(1, 12))

#> lags statistic df p-value

#> 1 2.481488 1 0.115193236

#> 2 9.242763 2 0.009839194

#> 3 9.320394 3 0.025320868

#> 4 9.330291 4 0.053353656

#> 5 10.248907 5 0.068482075

#> 6 10.398756 6 0.108833047

#> 7 12.439184 7 0.087010028

#> 8 14.265193 8 0.075109784

#> 9 16.177062 9 0.063274884

#> 10 16.247091 10 0.092774254

#> 11 16.250588 11 0.132079904

#> 12 26.309947 12 0.009700248Is the Nominal Interest Rate the Optimal Predictor?

model1 <- lm(cpi_inflation ~ tbill_1, data = fama)

summary(model1)

#>

#> Call:

#> lm(formula = cpi_inflation ~ tbill_1, data = fama)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -7.1795 -1.8660 -0.2112 1.8817 8.1608

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -0.8699 0.4231 -2.056 0.041 *

#> tbill_1 0.9930 0.1200 8.277 1.2e-14 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 2.78 on 221 degrees of freedom

#> Multiple R-squared: 0.2366, Adjusted R-squared: 0.2332

#> F-statistic: 68.51 on 1 and 221 DF, p-value: 1.197e-14How to get robust standard errors?

library(sandwich)

library(lmtest)

#>

#> Attaching package: 'lmtest'

#> The following object is masked from 'package:hayashir':

#>

#> moneydemand

coeftest(model1, vcov = vcovHC(model1, "HC0")) # white's

#>

#> t test of coefficients:

#>

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -0.86987 0.42405 -2.0513 0.04141 *

#> tbill_1 0.99301 0.10948 9.0702 < 2e-16 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1library(car)

#> Loading required package: carData

#>

#> Attaching package: 'car'

#> The following object is masked from 'package:dplyr':

#>

#> recode

linearHypothesis(model1, "tbill_1 = 1", white.adjust = "hc0")

#> Linear hypothesis test

#>

#> Hypothesis:

#> tbill_1 = 1

#>

#> Model 1: restricted model

#> Model 2: cpi_inflation ~ tbill_1

#>

#> Note: Coefficient covariance matrix supplied.

#>

#> Res.Df Df F Pr(>F)

#> 1 222

#> 2 221 1 0.0041 0.9492